0 to 1—Developing New Product opportunities in the Mortgage Industry

Summary

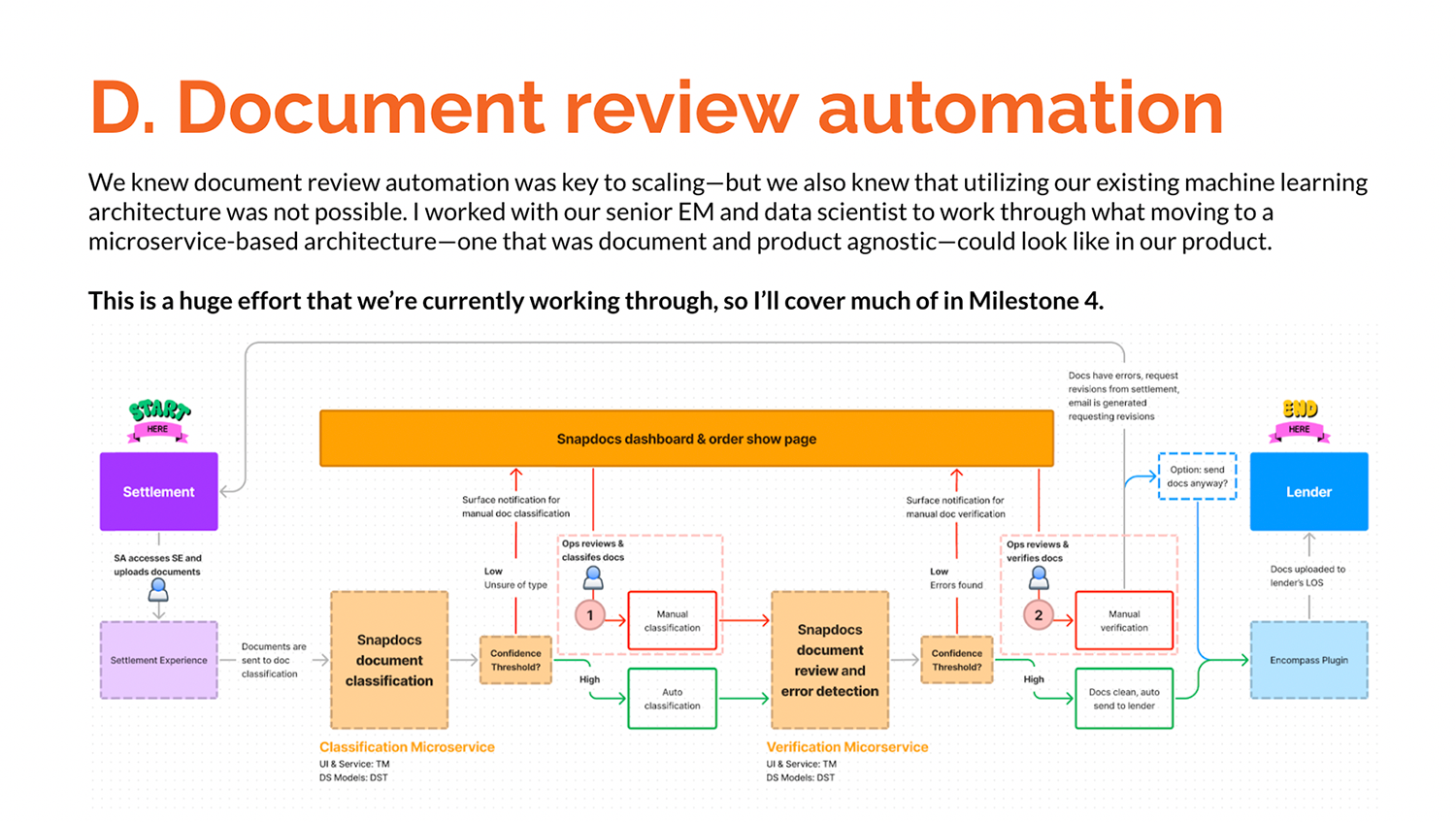

A mortgage tech company with a platform that powers over 3,000,000 real estate closings per year. By acting as the connective infrastructure in an otherwise fragmented industry, Snapdocs simplifies the closing process with intuitive products, automated workflows, powerful integrations, and machine learning. The new products team is responsible for exploring opportunities outside of our core competencies, looking for new problems to solve that could help improve the lives of our customers.

Problem Statement

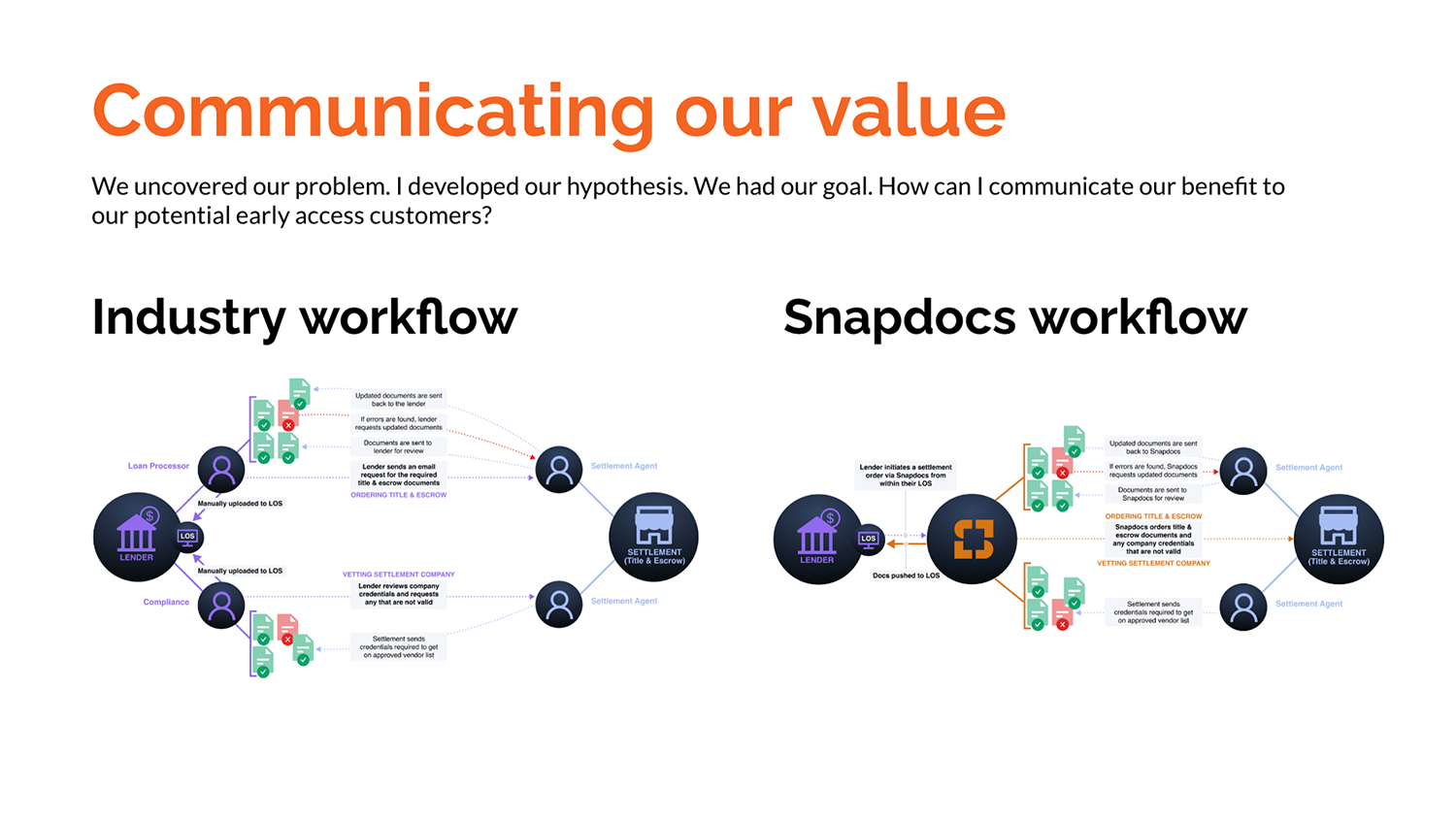

The mortgage space is filled with myriad of institutions, regulations, personas, legacy software, and immense fragmentation. Each piece of the mortgage puzzle is solved by a different role, and each of those roles often have a different way of performing their job. It is for these reasons that defragmenting the mortgage industry is fraught with challenges, and oftentimes, failures. For the new products team, we were focused on uncovering value and solving problems within the following institutions: lenders (our customers) and settlement companies.

Project Goals

- Research existing problems and market inefficiencies in the mortgage industry that could lead to new product opportunities.

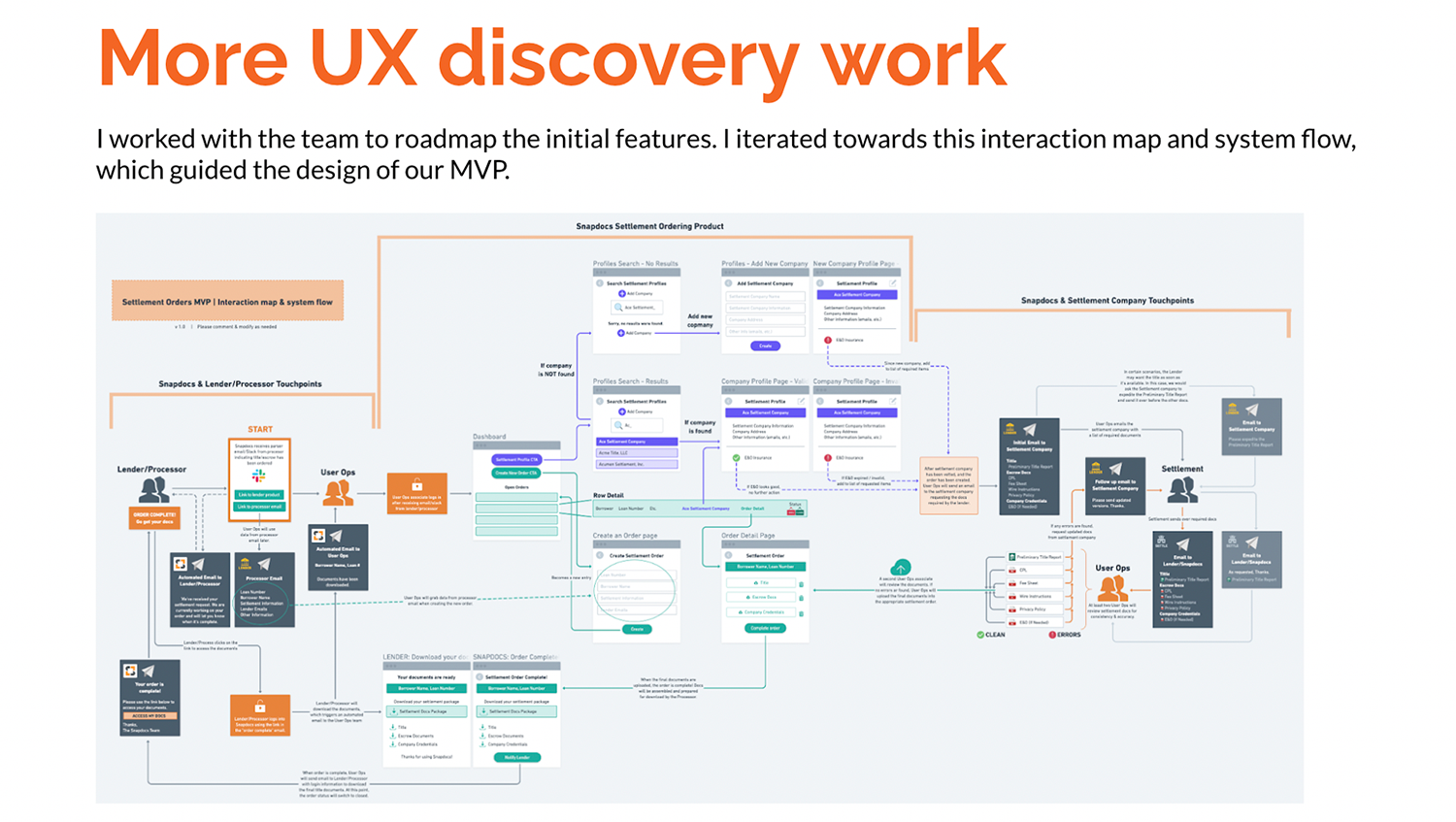

- Partner with product, engineering, and user ops to build out a team to explore product ideas and develop an MVP.

- Partner with an early access customer to help refine key features and guide product direction.

- Ship an MVP, research and design future milestones, and roadmap the future for the GA launch.

This case study is available to review as a Google Slides doc. This was one of the more involved projects of which I've been a part, starting quite literally with me and my PM trying to figure out what problems to solve during my second week on the job and ending after I helped steer the product to the number four priority at the company, onboard four paying customers, and build out a team of 18 associates. Unfortunately, the product was a casualty of the mortgage downturn during the summer of 2022.

This case study is extremely detailed, focusing on the initial ideation process, team creation, generative and evaluative research, product design, complex user flows, systems thinking, automation and machine learning workflows, legacy systems integration, and measuring design impact. I'm slowly converting this case study to HTML, but in the meantime, I'd still love to share it! If you're interested, send me an email and I'll provide the link.

Here's a quick preview of the case study